Published on April 8th, 2019

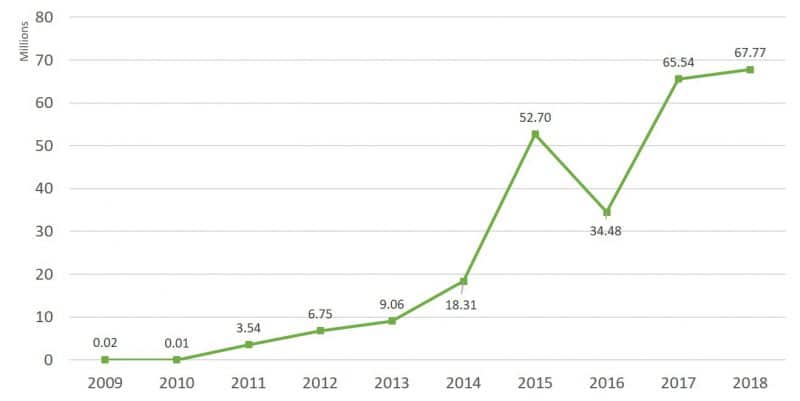

IPv4 Market Group’s analysis on the IPv4 transfer market is that transfers have held steady in 2018 from 2017. IPv4 transfers were almost equal to what they were in 2017, as shown in Figure 1.

Let’s make a few observations.

The total volume of transfers in both years were driven by large transfers. The peak in 2017 is partly a result of a number of large purchases including:

In addition, this peak was somewhat inflated as a large number of IPs were transferred within corporate structures and were therefore not sold. For example, it appears that SFR of France transferred over 5m IPs internally within its organizations.

The transfers in 2018 strongly mirror those in 2017, in that there were many very large transfers between industry-leading corporations. This is a result of large purchases including: 4.19m IPs To Google from General Electric in March;

And like 2017, there were some large internal transfers in 2018, such as the internal transfer of 2.7m IPs within TalkTalk Communications Limited of the UK.

Figure 2 is a graphical depiction that shows the IPv4 transfer market can be volatile, for example, the dip in transfers in 2016. But there is a rise to consistency in the following two years largely because of the similar volume of large block transfers (of /16 and larger).

Of course, the next question is where will the transfer volume go in 2019 and beyond? It seems to us that IPv4 transfer volumes may decrease over time going forward. As we know there are fewer legacy /8s pre-dating ARIN remain to be sold. Hence, the supply side for these large transfers, which drive the market, is going down. Demand is still there but it seems supplies will run out.

Will 2019 be three years in a row of large IPv4 transactions between large corporations? Let’s stay tuned to see if 2019 transfers are lower, or perhaps the remaining /8s will all go in the next year to keep transfers up.