Published on January 28th, 2014

Would you believe that I have now been in the IP transfer business for four years? In January of 2010, I was working at Nortel as the Director of Network Engineering, leading the team looking into the monetization of Nortel’s IPv4 assets. This culminated in the sale of nine /16s to Microsoft in the spring of 2011. Fast forward three years, and a lot has changed in the IPv4 marketplace.

While transfers are now published on the RIR websites, there is little transparency in terms of price. IPv4 Market Group has been pushing for no needs justification on IPv4 transfers since our inception in May of 2011, and RIPE NCC is poised to implement this policy, with our profound support. In the past we have spoken of the inefficiency of ARIN and APNIC in their approach to needs justification. We hope once ARIN runs out, they, like RIPE NCC before them, will realize it is inappropriate to ask a buyer to justify need for resources that ARIN is no longer capable of allocating.

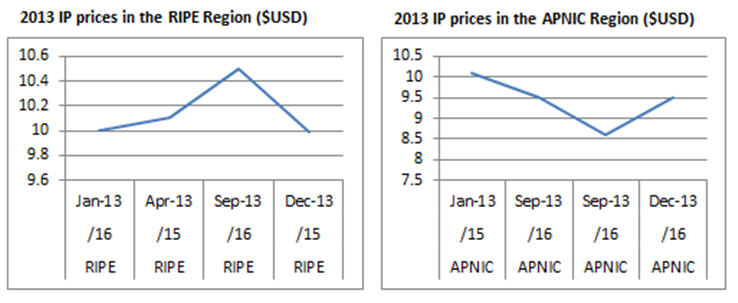

Let’s start with a look at 2013 in review by talking about our experience with prices. In general we found that prices fell slightly during 2013, and we found that prices are higher in the RIPE region than in the APNIC and ARIN regions. This is probably due to three reasons. First, RIPE is a closed marketplace, where the number of IPs available for transfer is only those within the region. Secondly, we find that the economies of many countries in Asia cannot support the higher asking prices and many companies find that the purchase of IPs is beyond their means. Thirdly, ARIN continues to give out IPs from its free pool. As long as these three factors continue, we expect relative price trends to continue.

Specifically, /16 prices in the RIPE region started 2013 at slightly more than $10.00 per IP. Our experience was that there was a slight increase in price, and the larger blip shown on the RIPE graph below was for a small premium for legacy IPs. In Asia, /16 prices started out also at $10.00 per IP, but dropped slightly during the year.

There are a few factors that affect price, and supply versus demand is certainly a key macro factor. Micro factors influencing price per IP are aggressive buyer closing dates, seller urgency to monetize, benefit of being a repeat seller or buyer for process efficiency, and buyer willingness to accept blacklisted/blocked IPs from seller. We also find that companies prefer to buy IPv4 addresses in-region. For example, if given a choice, most Asia based companies will pay a small premium to buy APNIC IPs, in part to avoid the extra process and complication created by inter-regional transfers with ARIN, and in part because they prefer Asian contract law, and some North American firms will not accept this.

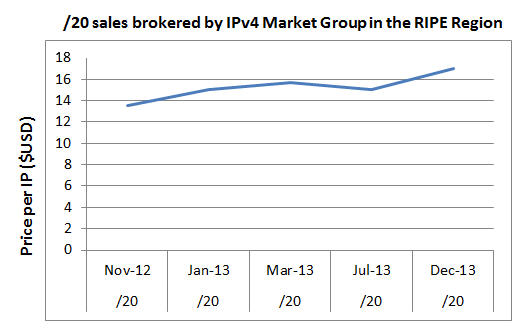

We also find that smaller blocks sell at higher prices. For example, consider the following five sales of /20s that we completed in the RIPE region in 2013:

The $5.00 USD per IP premium is to compensate for the fact that the cost and effort to sell a /20 is equivalent to the cost and effort to sell a /16. Blocks in between a /16 and /20 in size are priced anywhere between $10.00 and $15.00 USD, generally speaking.

What are our predictions for 2014? We don’t see any upward movement in price in ARIN or APNIC until ARIN runs out of free IPs. We think ARIN will run out late in the third quarter of 2014, but this could change depending on whether it gives out /12s to its large customers. Coincidentally, LACNIC will run out of its free pool at about the same time as ARIN. RIPE prices should remain stable for at least six more months as supply meets demand. Then prices will probably start to rise toward the end of the year as supplies start to tighten.

IPv4 Market Group has completed over 70 global transactions since our inception in May of 2011 and has experience with a wide variety of transaction types and services. Our observations are based on fact and real life data points.

- By Sandra Brown