Published on March 9th, 2015

In general APNIC’s market is less robust than expected, with 3.75 million IPv4 addresses transferred in 2014, versus almost 10 million in RIPE region. Why is there this difference?

It would seem the major region is the economies.

When one examines the number of IPs transferred by country, one sees haves versus the have-nots.

| AF | 1,024 |

| AP | 11,008 |

| AP | 256 |

| AU | 629,504 |

| BD | 14,336 |

| CN | 1,208,832 |

| HK | 423,936 |

| ID | 12,288 |

| IN | 317,184 |

| IN | 4,096 |

| JP | 685,824 |

| KH | 2,048 |

| KR | 2,048 |

| MY | 136,192 |

| NP | 16,384 |

| NZ | 19,200 |

| PF | 16,384 |

| PG | 2,048 |

| PH | 14,336 |

| PK | 6,144 |

| SG | 270,336 |

| TH | 91,136 |

| Grand Total | 3,884,544 |

|---|

Surely India, with arguably the most people in the world, should have the most IPs transferred, but it is well down the list. And China and Japan are only starting to emerge, and Korea isn’t really bothering with transfers, perhaps because of the fact it already has the 3rd most IPs in APNIC.

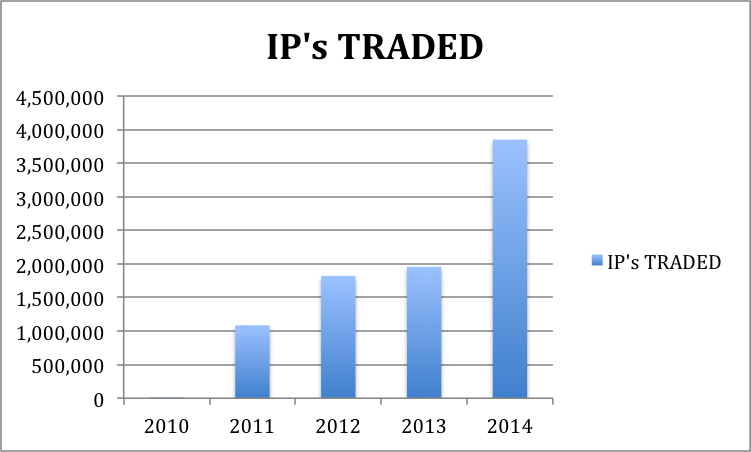

In looking at the history of IP trading in APNIC region, there has been steady growth, culminating in almost 4 million IPs transferred in 2014.

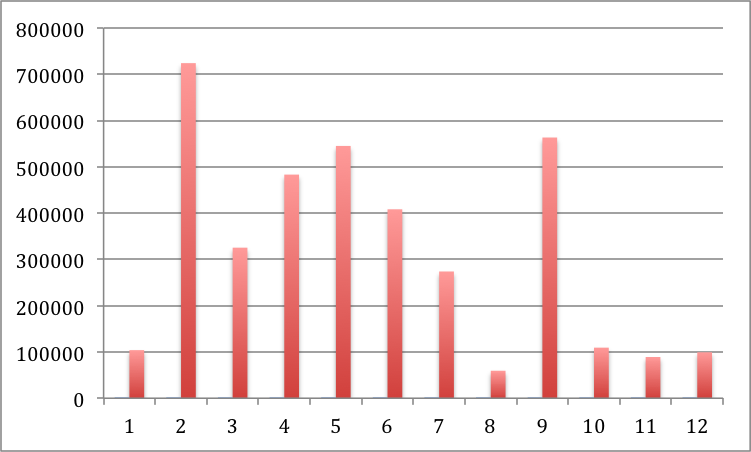

The next picture looks at the IP’s transferred by month in 2014. There really has not been a steady monthly growth pattern, as it seems to depend on isolated transfers.

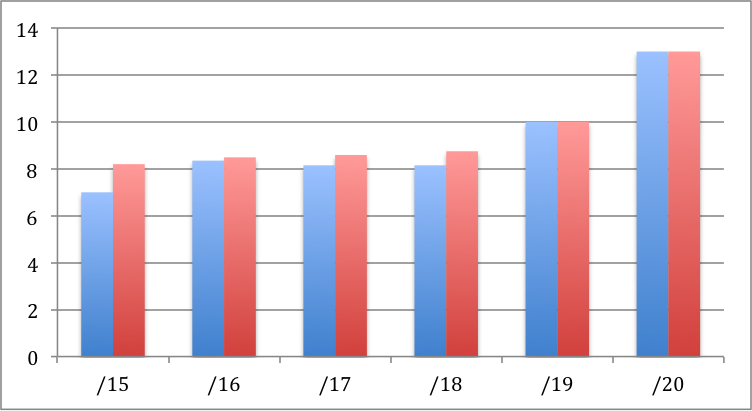

The number of each block size transferred is interesting. It ranges from only 1 /13 and 1 /14 to 3 /15’s, 23 /16’s and then all the way to 76 /24's. The sweet spot, representing the most IPs is the /16, with 1.5 million IPs represented.

| Block Size | Num of Blocks | Total IP's |

|---|---|---|

| /13 | 1 | 524,288 |

| /14 | 1 | 262,144 |

| /15 | 3 | 393,216 |

| /16 | 23 | 1,507,328 |

| /17 | 12 | 393,216 |

| /18 | 10 | 163,840 |

| /19 | 27 | 221,184 |

| /20 | 29 | 118,784 |

| /21 | 30 | 61,440 |

| /22 | 55 | 56,320 |

| /23 | 61 | 31,232 |

| /24 | 73 | 18,688 |

| Grand Total | 325 | 3,751,680 |

In terms of prices, I can speak only to the prices observed by IPv4 Market Group in the APNIC region. Where we had multiple transfers for a range, I show the range. Beginning with /15’s we saw between $7 and 8.20/IP. For /16’s $8.35 to $8.49. For /17, $8.15 to $8.59. For /18 $8.15 to $8.75. For /19, the price is $10/IP and for /20 $13 per IP. Prices seemed to decline through the year.

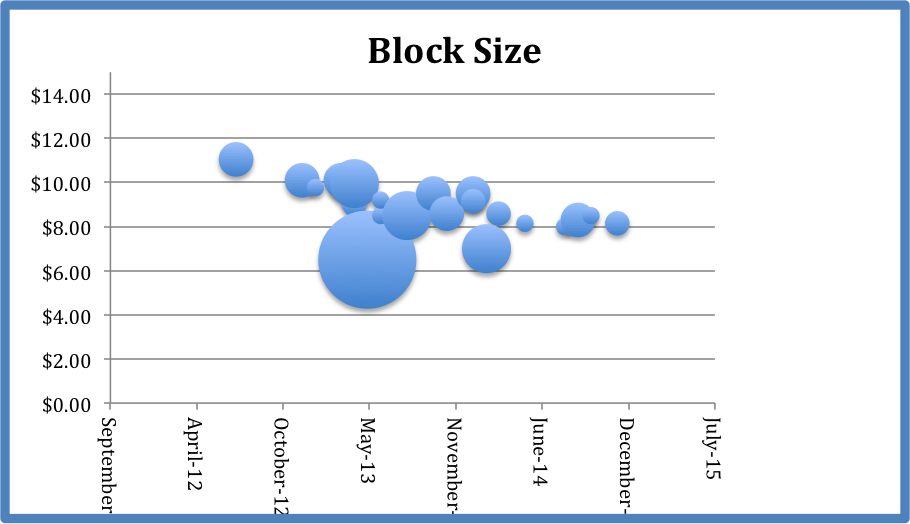

In looking at the price trends over the last 3 years, we have seen a slight downward trend. The size of the bubble represents the size of the block. Larger blocks sell for less.

We are seeing very tight supplies right now in APNIC region relative to demand. The supplies in ARIN region are keeping prices low for now, but this may change when ARIN runs out. Yesterday the ARIN counter was at .31 /8’s so runout may be in a month or two. We also see that companies will pay a small premium for APNIC region IPs to ARIN escrow and ARIN processes.

And so, we appear to be at a price minimum for APNIC blocks – supplies are tight, ARIN runout is imminent, and demand is increasing. We will keep you posted on what we see in the months ahead, but the message seems to be, “Buy now if you will need IPS in 2015-16.”