Published on November 3rd, 2017

It has been a few months since we have commented on IPv4 transfer trends and we thought it would be interesting to determine, after transfers fell between 2015 and 2016, whether the reduction in transfers continued. So, we ran the numbers.

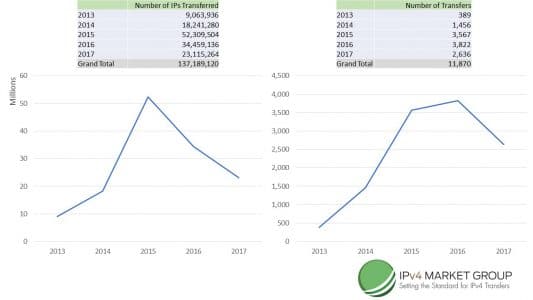

Noting that the 2017 data is for 9 months, and not a full year, it seems that both the number of IPs transferred and the number of transfers will further decline in 2017. Year to date the number of IPs transferred in 2017 is 23.1 million IPs. If we are optimistic and assume that this pace will continue for the last three months of the year, then only 30.8 million IPs will transfer by the end of 2017. This is down from 34.5 million IPs transferred in 2016 and 52.3 million in 2015, which is a significant decline of 10.6% in 2017 after a 34% decline in 2016.

In terms of the number of IPv4 transfers, our extrapolated number for 2017 is 3,515 global transfers. This will be down from 3,822 in 2016 and 3,567 in 2015.

Is the IPv4 market really declining? To help answer this question we looked at specific block sizes.

Within the last year, it appears that block sizes of /17 and smaller are decreasing in number of transfers. For example, there were 54 /17 transfers in 2016 and only 36 in 2017 (year to date).

Conversely, /15 and /16 transfers are holding their own. If we extrapolate the 108 /16 transfers at the end of September to a full year, we see there are 144 transfers expected in 2017, slightly more than the 131 transfers in 2016.

The final question is whether this is a global or regionalized phenomenon. When we looked at RIPE, ARIN, and APNIC as separate regions, we saw that APNIC dropped from 521 transfers in 2016 to 270 transfers in 2017 (year to date). RIPE dropped from 2,303 transfers in 2016 to 1,353 transfers in 2017 (year to date). ARIN, on the other hand, has already increased in total transfers between 2016 and 2017, as it has gone from 797 total transfers in 2016 to 836 in 2017 (year to date).

What does this tell us about the state of the IPv4 Market? It seems to be healthy, but we are seeing that it is harder to find quality /18s and smaller blocks that are not blacklisted. The decline is in the smaller space, and in the meantime, /16 and larger blocks continue to move as demand exceeds supply. We expect supplies to continue to tighten in 2018, and the transfer statistics in the months ahead will tell the tale. Contact us today for a free consultation.